Explore the Power of Online & Mobile Banking

Online and Mobile Banking from Jonah Bank allows you to access your accounts 24 hours a day, 7 days a week, 365 days a year! Check your balance, transfer funds, view statement history, download transactional data, make loan payments, pay your bills and friends, view check images, complete commercial payments, and more from the convenience of your home or any place you can access the internet. Best of all, Jonah Bank's basic online and mobile banking service is FREE*.

* Some Commercial functions incur a small monthly fee.

Autobooks

If you need an easy way to accept payments, check out Autobooks. Jonah Bank now offers Autobooks, an easy-to-use solution that includes everything you need to stay on top of your business — digital invoicing and payment acceptance, plus accounting and reporting. Access it inside your Jonah Bank online and mobile banking and try it for yourself!

Card Valet

Card Valet® is a stand-alone App offered by Jonah Bank that puts the control of your Debit and Credit Cards in your hands.

Card Valet® enables you to:

- Turn your Cards Off and On

- Limit Spending on Cards by Category or Merchant Type

- Restrict Card Use to Specified Geographic Locations

- Restrict ATM or Online Transactions

- Receive Real-Time Transaction Alerts

To get started with Card Valet®, download the App from the respective Apple Store or Android Store today.

Online Banking eVideos

We know that our Online Banking system offers a vast number of tools for you to get the job done, and it can seem overwhelming at first. That's why we have created a series of short and to the point eVideos for you. If you prefer to have a hard copy guide to follow, don't worry we have that too below the videos. Should you have any questions on any of the features in our Online Banking System, our friendly staff are always here to help!

Jonah Bank: Personal Banking

Jonah Bank: Business Banking

Jonah Bank: Mobile Banking

Jonah Bank: Secure Banking

Jonah Bank: Bill Pay

Commercial Online Banking eGuide (printable)

You can navigate our interactive user guide by clicking a topic or feature in the Table of Contents. Each section provides an overview and steps to help you during the online banking process. If you have additional questions, contact us at 307.237.4555.

Click on our Online Banking Guide to get started.

Consumer Online Banking eGuide (printable)

You can navigate our interactive user guide by clicking a topic or feature in the Table of Contents. Each section provides an overview and steps to help you during the online banking process. If you have additional questions, contact us at 307.237.4555.

Click on our Consumer Online Banking Guide to get started.

Mobile Banking

Your Bank at Your Fingertips

With the latest Jonah Bank Mobile App and our Online Banking System, we are providing you with a familiar and unified user experience. With all the features you need in our Mobile App, it's like having your bank in your pocket wherever you are. The Jonah Bank Mobile App is available on iOS® and Android®.

Features of Mobile Banking

- Check Account Balances, Verify Deposits, and Review Transactions

- Transfer Funds

- Review Account Statements

- Pay Bills

- Mobile Deposit

- Commercial Payments including ACH, Payroll, and Wires

- Setup Account and Security Alerts

- Contact Us

- Find Your Nearest ATM

* Take control of you Jonah Bank cards with the CardValet® App

* Locate 32,000 Surcharge Free ATMs nationwide with the MoneyPass® App

*The MoneyPass® and CardValet® Apps are separate Apps from the Jonah Bank Mobile Banking App

and are available on the applicable App Stores

Mobile Banking Getting Started

Jonah Bank's Mobile Apps are fast, free, and available to all Jonah Bank customers in the Apple App Store and Google Play Store.

Get Up and Running Fast with These Steps:

- Open the respective store, search for and install the Jonah Bank of Wyoming App (Note: you should only download the Jonah Bank App from the authorized App store)

- Tap to open the Jonah Bank App

- Enter your Username and Password (the same as your online banking credentials)

- The first time you use the Mobile App, you will be prompted for a secure access code, select where you want to receive the code, and submit it once you receive it

- Make your preference to either register the device or not

That’s it! You now have your bank in the palm of your hand!

Mobile Banking Security Tips

To help secure your mobile device and complete Activity on your device, Jonah Bank has the following recommendations:

- Use a Pin Lock or screen lock for your device, and stay away from easy pins like 123456

- Use Biometrics

- Do not store your login credentials as a contact on your phone; instead, use a password wallet

- Enable and know how to use features such as Find My Phone

- Should you lose your phone, report it to us, and we can remove the device registration in our system

- Learn how to remotely wipe your device

- Turn off additional mobile features such as Bluetooth and geolocation services when not needed

- Before downloading any App, read reviews about the App developer or company publishing the App and review the App permissions that will be allowed once the App is downloaded.

- Install Mobile Malware and Antivirus Protection

- Avoid connecting to unknown wireless networks. These networks could be rogue access points that capture information passed between your device and a legitimate server.

- Reset or wipe devices before they are sold or traded

- Keep smart-phone software patches and upgrades up to date

- Avoid links or software downloads from unknown sources

- Use the same precautions on a mobile device as you would use on a PC: Stop-Think-Connect!

Minimum Device & Browser Requirements

To get the most out of all the great features available in our Online & Mobile Banking Systems, there are some minimum requirements and recommendations we have:

Money Pass

We get it, paying to access your money doesn't feel right, that's why we joined the MoneyPass® network, so you get access to over 32,000 surcharge-free ATMs nationwide. Wherever you roam, you can find a surcharge-free ATM by going to www.moneypass.com, or using the link under services in online or mobile banking.

What are you waiting for? Start using surcharge free ATMs today!

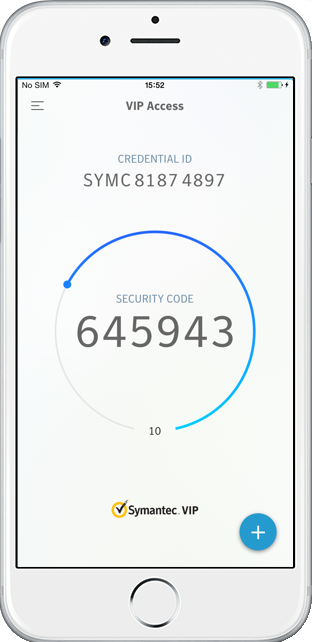

Symantec VIP Tokens

Jonah Bank utilizes two types of Symantec VIP Tokens for out of band One Time Passcodes (OTP's) to secure all outbound transactions from your account. Jonah Bank uses physical tokens and virtual tokens generated within an application on your mobile device. Once you have been provided with a physical token or have registered your virtual token with a Jonah Bank staff member, you will need to activate it within online banking when approving a transaction.

Note: These tokens periodically will need to be re-activated.

Physical Tokens:

Virtual Tokens:

Available from the Apple App Store or Google Play Store

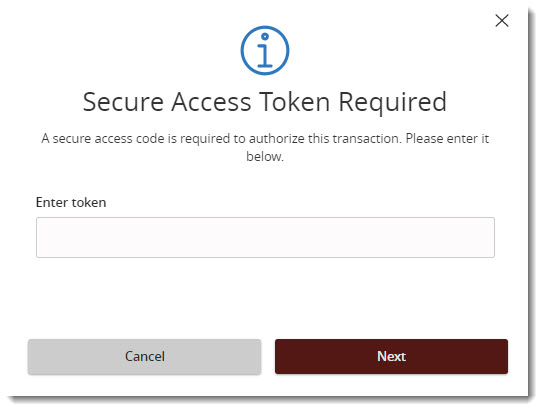

Activating Your Symantec Token

Whether you are activating a Physical or Virtual Token, the process is the same:

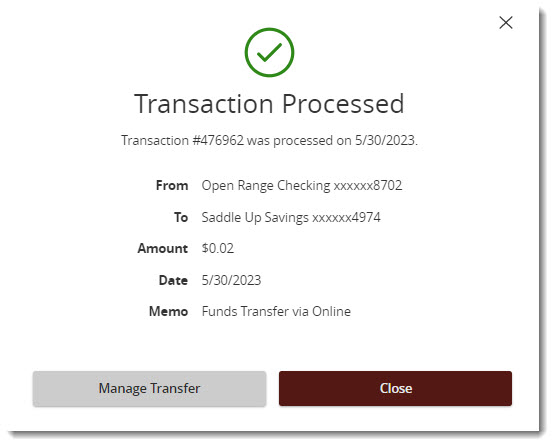

- Create and approve a transaction.

- When prompted for your Secure Access Token, press the button on the Physical Token or open your Symantec VIP App on your device and enter the displayed code in the field shown in online banking then select Next.

- After entering your code for the first time, the system will ask for a second code to activate the token. For Physical Tokens, please wait until the screen goes blank and then, press the token button again to obtain your second code. For Virtual Tokens, wait for the timer to reach zero and a new code will be displayed.

- Enter the second code in the token field within online banking and then select Verify.

5. Your token will be activated and the transaction approved. Then, you can select close

on the approved message window.

Should you encounter any trouble in activating your Symantec Physical or Virtual Code, please contact Jonah Bank.

Text Banking

Stay Connected Wherever You Go!

Text Banking is another great way to stay connected with your bank account wherever you are. FREE* with your Jonah Bank account and simple to use!

Text Banking can be used to quickly:

- Get Account Balances

- View Account History

- Transfer Between Accounts

- While Jonah Bank does not charge for Text Banking, your cellular phone carrier may charge per SMS message sent and received. You must contact your cellular phone carrier for details regarding any fees they may charge.

To Get Started With Text Banking

- Sign in to Online Banking

- Navigate to Settings, then Text Enrollment

- Turn on Text Banking, enter your cell phone number, and check the box to agree to the Text Banking Terms & Conditions

- Select Save

- Follow the prompt to go to Account Preferences to set up your account nicknames for Text Banking

Using Text Banking

To use Text Banking, text any of these commands to BANKME (or 226563)

Text Banking Tips

Jonah Bank Doesn't Charge for Text Banking

There is no cost to enroll in Text Banking. Jonah Bank does not charge you for this convenience. Check with your mobile carrier for any specific fees or charges that may apply for sending or receiving text messages.

Lost or Stolen Mobile Phone

Cancel Text Banking immediately by calling customer service at 1.866.504.5111. Or you can sign in to Online Banking and navigate to Settings > Text Enrollment > Turn off Text Enrollment to delete your cell phone number, and then click/tap on Save. If you find your mobile device later, you can re-enroll the same mobile number.

Getting Multiple Messages

You may receive more than one message if the message is longer than 160 characters (the limit for our text messages). For a transaction history inquiry, the response may require multiple messages.

Changing Your Mobile Number or Service Provider

Sign in to Online Banking and go to Settings > Text Enrollment > Edit Number to change your mobile number.

Ending Your Text Banking Service

Texting STOP from your cell phone device will stop all Text Banking Commands on your device. To re-enable text banking, you will need to set it up again from within online banking and issue the START command from your device.

For assistance with our Mobile and Text Banking systems, feel free to contact us anytime.

Additional Quick Reference Guides

- Mobile App Security Tips

- Multi-Factor Authentication (MFA)

- Online Banking Security Guide

- Text Banking

Still have questions?

Call our support staff for all of your questions:

Troubleshooting

It stinks when things don't work when you need them to. Often the browser we use to access Online Banking can cause problems with logging in, accessing statements or check images, or not displaying a feature, function or option. To help you access the features you need from Online Banking, we would love for you to call Jonah Bank and talk with one of our staff. However, if you want to troubleshoot it yourself first, we recommend you try the below troubleshooting steps.

Check for and Update Browser Version

Using the latest version of the supported browser will ensure a secure and optimal experience with Jonah Bank's Online Banking.

- Chrome - Update Google Chrome

- Edge - Find out which version of Microsoft Edge you have or Microsoft Edge Update Settings

- Firefox - Update Firefox to the latest release

- Safari - Update or reinstall Safari for your computer

Clear Browser Data (Cache)

When you use a browser like Edge, Firefox or Chrome, it saves some information from websites in the cache to improve loading times and performance. Clearing this information can help fix loading or formatting issues on sites, especially if a change was made since the user's last visit. These steps can help with problems related to accessing statements or check images, or the browser not displaying a feature, function, or option.

- Chrome - Clear browsing data

- Edge - View and delete browser history in Microsoft Edge

- Firefox - How to clear the Firefox cache

- Safari - Clearing your browsing history in Safari on Mac

Clear and Manage Cookies

Cookies are files created and used by the websites you visit to store your login state, remember your site preferences, or personalize content. You should clear cookies regularly, especially if using a shared device to improve browser speeds and security. You may also need to allow cookies for specific sites that use a single sign-on (SSO) experience.

CAUTION: we recommend only clearing the cookie for the site that is not working, removing all cookies may force you to re-register your browser with all the sites you visit. For Jonah Bank's Online Banking System, we recommend searching your cookie store for "Jonah Bank" and removing only Jonah Bank cookies.

- Chrome - Clear, enable, and manage cookies in Chrome

- Edge - Delete cookies in Microsoft Edge or Temporarily allow cookies and site data in Microsoft Edge

- Firefox - Clear cookies and site data in Firefox

- Safari - Manage cookies and website data in Safari on Mac

Block or Allow Pop-Ups

Some pages may use pop-ups to display the information you requested such as estatements. If pop-ups are not enabled, you may receive an error message, or the document will fail to show. Your IT Staff or you may have installed a security extension in your browser such as U-Block Origin. It is important to check that this browser extension is not blocking pop-ups for Jonah Bank as well as your browser's default pop-up blocker.

- Chrome - Block or allow pop-ups in Chrome

- Edge - Block pop-ups in Microsoft Edge

- Firefox - Pop-up blocker settings, exceptions, and troubleshooting

- Safari - About pop-up ads and windows in Safari

Clear Stored Passwords

All browsers have a convenient feature allowing you to remember the username and password for a site you have authenticated to. This feature often causes login failures to occur when you change your password for a site the browser has remembered. If you encounter consistent login failures every time you visit www.jonah.bank, we recommend clearing the stored password from your browser.